SPOTLIGHTED PODCAST ALERT (YOUR ARTICLE BEGINS A FEW INCHES DOWN)...

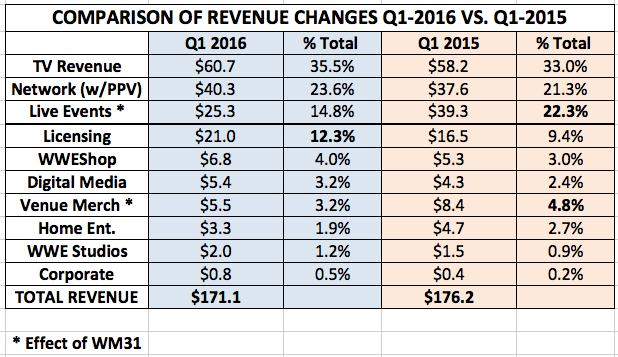

WWE reported First Quarter 2016 revenue of $171.1 million, down from Q1-2015 when including the effect of WrestleMania, but up from Q1 if excluding WrestleMania for comparability.

TV Rights Revenue continues to be the company’s key revenue and profitability driver, followed by WWE Network. WWE noted in the footnotes of their earnings presentation that a re-allocation of expenses starting in January 2016 improved TV profitability.

Meanwhile, Live Events fell by a significant amount due to the comparability of WrestleMania business. Removing the effect of WrestleMania, the segment increased slightly.

However, WWE said domestic live events were flat, as a 6 percent increase in average ticket prices was offset by a 9 percent decline in average attendance.

First Quarter 2016 Business Break Down

TOTAL REVENUE: $171.1 million

TOTAL BUSINESS OPERATIONS PROFIT: $27.6 million (up from $21.0 million in Q1-2015)

Media Division ($109.7 revenue – 64% of total, up from 60% in Q1-2015)

– WWE Network Revenue: $38.2 million, up 34 percent from $28.6 million in Q1-2015.

- PPV Revenue: $2.1 million, down from $9.0 million in Q1-2015.

- Total Segment Revenue: $40.3 million, up 7 percent from $37.6 million in Q1-2015.

– WWE Network Profit: The segment (Network & PPV) generated $15.8 million in earnings, up from a loss of $1.5 million in Q1-2015 as part of WWE still recouping Network start-up costs. In-between WM31 and WM32, the Network became profitable for the company.

***

– TV Rights Revenue: $60.7 million, up 4 percent from $58.2 million in Q1-2015.

WWE said TV Rights continues to escalate “due to contractual increases in key distribution agreements, the largest of which became effective in the fourth quarter 2014 and the first quarter 2015.” Plus, one additional episode of “Total Divas” in Q1-2016 vs. Q1-2015.

– TV Rights Profit: $28.3 million, up from $25.9 million in Q1-2015.

WWE noted: “The Company started allocating certain shared expenses between its Network and Television segments. Management believes this allocation more accurately reflects the operations of these segments. For the first quarter 2016, the implementation of this allocation methodology reduced Network segment profit by $3.3 million and increased Television segment profit by a corresponding $3.3 million.”

***

– Home Entertainment Revenue was $3.3 million, down from $4.7 million in Q1-2015.

Profit was $1.5 million, down from $2.1 million in Q1-2015.

– Digital Media Revenue was $5.4 million, up from $4.3 million in Q1-2015.

However, despite the revenue increase, the segment turned the same net loss of $0.1 million.

Live Events Division (15%, down from 22%)

– Live Events Revenue was $25.3 million, down from $39.3 million including the effect of WrestleMania and slightly up from $23.6 million excluding the effect of WrestleMania.

– Live Event Profit was $6.1 million, down from $17.6 million in Q1-2015.

Removing the effect of WrestleMania, profit was still down from $6.5 million last year to $6.1 million this year.

Consumer Products Division (19%, up from 17%)

– Licensing Revenue was $21.0 million, up 27 percent from $16.5 million in Q1-2015.

WWE attributed this to “higher video game revenue in domestic and international markets, which derived from higher effective royalty rates than in the prior year quarter.”

Profit was $14.3 million, up from $10.8 million in Q1-2015.

– Venue Merchandise was $5.5 million, down from $8.4 million in Q1-2015.

This was attributable to the timing of WrestleMania, plus a decrease in domestic attendance meant fewer people in the building to buy merchandise.

Excluding the effect of WrestleMania, venue merch was slightly up from $5.1 million to $5.4 million.

Profit was $2.0 million, down from $3.2 million in Q1-2015.

– WWE Shop Revenue was $6.8 million, up from $5.3 million in Q1-2015.

Profit was $1.4 million, only slightly up from $1.1 million in Q1-2015, reflecting the low margins for the merchandising business.

WWE Studios Division (1%)

– WWE Studios Revenue was $2.0 million, up from $1.5 million in Q1-2015.

However, the segment continues to report a loss. It was the same loss of $0.4 million.

Corporate & Other (1%)

– WWE’s Corporate & Other segment reported $0.8 million in revenue, up from $0.4 million in Q1-2015.

However, costs that reduce business operations profit were $41.3 million, up from $37.7 million in Q1-2015.

WWE said there was a $4.0 million increase within the segment “primarily due to increases in Business Support costs, including certain talent expenses.”

Leave a Reply

You must be logged in to post a comment.