SPOTLIGHTED PODCAST ALERT (YOUR ARTICLE BEGINS A FEW INCHES DOWN)...

WWE Fourth Quarter 2015 Business Break Down

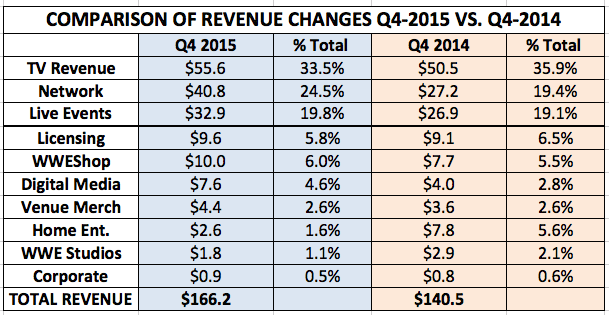

– Total Revenue: $166.2 million, up 18 percent from $140.5 million in Q4-2014.

Adjusted Business Profit was $11.1 million, doubling $5.1 million in Q4-2014 during the Network ramp-up phase.

– Domestic Revenue: $115.4 million (70 percent of the total), up 7.5 percent from $107.3 million in Q4-2014.

– International Revenue: $50.8 million (30 percent of the total), up 53 percent from $33.2 million in Q4-2014. This was mainly driven by the accessibility of WWE Network and “escalation of TV Rights Fees.”

Individual Business Segments

Media Division

– Total Revenue of $106.6 million (64 percent of total), up 19 percent from $89.5 million in Q4-2014.

- Television Revenue was $55.6 million, up 10 percent from $50.5 million in Q4-2014 due the escalation of new TV deals.

- Network Revenue was $37.2 million, up 60 percent from Q4-2014 during the ramp-up period.

- Within the Network segment, PPV Revenue was $3.6 million. WWE counts both items within the Network segment for a total of $40.8 million.

- Home Entertainment was only $2.6 million, down 67 percent from $7.8 million in Q4-2014. WWE was hit hard by a “decline in effective prices” to only $8.34 per unit sold.

- Digital Media was $7.6 million, up 90 percent from $4.0 million in Q4-2014. The interesting thing is last year’s Digital Media segment lost revenue from people buying fewer PPVs on their website due to the Network switch-over. WWE said the number increased this year “primarily due to higher advertising revenues.”

– Profit was $41.0 million (38 percent profit margin), an improvement on $29.8 million (33 percent margin) in Q4-2014.

- TV Profit was $23.3 million, an improvement on $18.9 million in Q4-2014.

- Network Profit was $15.0 million, an improvement on $6.8 million in Q4-2014.

- Home Entertainment Profit was minimal at $0.6 million compared to $4.6 million in Q4-2014.

- Digital Media Profit was $2.1 million, compared to a net loss of $0.5 million in Q4-2014.

Live Events Division

– Total Revenue of $32.9 million (20 percent of total), up 22 percent from $26.9 percent in Q4-2014.

WWE noted higher average domestic ticket prices and higher attendance at international shows helped boost the revenue segment. The first NXT U.K. Tour helped internationally.

- North American Live Event Revenue was $18.5 million, up 21 percent from Q4-2014. This was “driven by a 13 percent increase in the average effective ticket price.”

- The avg. ticket price was $51.59

- Average attendance was 6,300, an increase of 9 percent “in part due to the mix in venues.”

- Int’l Live Event Revenue was $14.3 million, up 24 percent from Q4-2014.

- Excluding the NXT tour, the avg. ticket price was $57.16, down 19 percent from Q4-2014, which “reflected changes in territory mix and unfavorable changes in foreign exchange rates.”

- Average attendance was 7,800, up 31 percent from Q4-2014.

– Total Profit was $7.3 million, an improvement on $4.6 million in Q4-2014. The profit margin was 22 percent, compared to 17 percent in Q4-2014.

Consumer Products Division

– Total Revenue of $24.0 million (14 percent of total), up 18 percent from $20.4 million in Q4-2014.

- Licensing Revenue was $9.6 million, up slightly from $9.1 million in Q4-2014.

- Within the segment is WWE’s action figure business. WWE cited a survey from NPD Retail Group that “WWE maintained its strong position in the toy market with the third highest selling action figure property in the U.S.”

- Venue Merchandise Revenue was $4.4 million, up from $3.6 million in Q4-2014. This was due to more big spenders in the audience at WWE shows, as per capita revenue increased six percent.

- WWE Shop Revenue was $10.0 million, up 30 percent from last holiday season’s $7.7 million.

- The number of orders increased 24 percent to 214,000

- Spending increased, too. Revenue per order was $46.43, up three percent. WWE credited “enhanced product assortment and expanded distribution through Amazon.”

– Profit was $7.9 million, an improvement on $7.0 million in Q4-2014. The profit margin was 33 percent, slightly down from 34 percent in Q4-2014.

WWE Studios Division

– WWE Studios Revenue was $1.8 million, down from $2.9 million in Q4-2014.

WWE reported a net loss of $0.2 million, compared to $0.4 million in Q4-2014. WWE has not reported a net gain since the first quarter of 2014.

Other Segments

– WWE recorded $0.9 million in Corporate/Other Revenue to round out their total.

The related expenses were $25.0 million in Corporate Support and $27.1 million in Business Sport, for a total Corporate Expense of $52.0 million, an increase of 39 percent.

WWE attributed most of the increase to a $7.1 million impairment charge related to abandoning their media center project.

COMPARISON OF CHANGES

– In the Fourth Quarter 2015, WWE became even more top-heavy, as TV Revenue, WWE Network, and Live Events produced $129.3 million revenue (78 percent) of the total.

In the Fourth Quarter 2014, the top three segments produced $104.6 million (74 percent of the total).

– In Q4-2015, TV Rights and WWE Network alone produced $96.4 million (58 percent of total revenue in the quarter).

In Q4-2014, TV Rights & Network alone produced $77.7 million (55 percent of total revenue in the quarter).

– The ancillary business segments made up 22 percent of revenue in Q4-2015, versus 26 percent in Q4-2014.

Leave a Reply

You must be logged in to post a comment.